As a dentist, you have lots of options to navigate when reviewing disability insurance plans.

One of the more significant variables is the way an insurance policy charges its premiums.

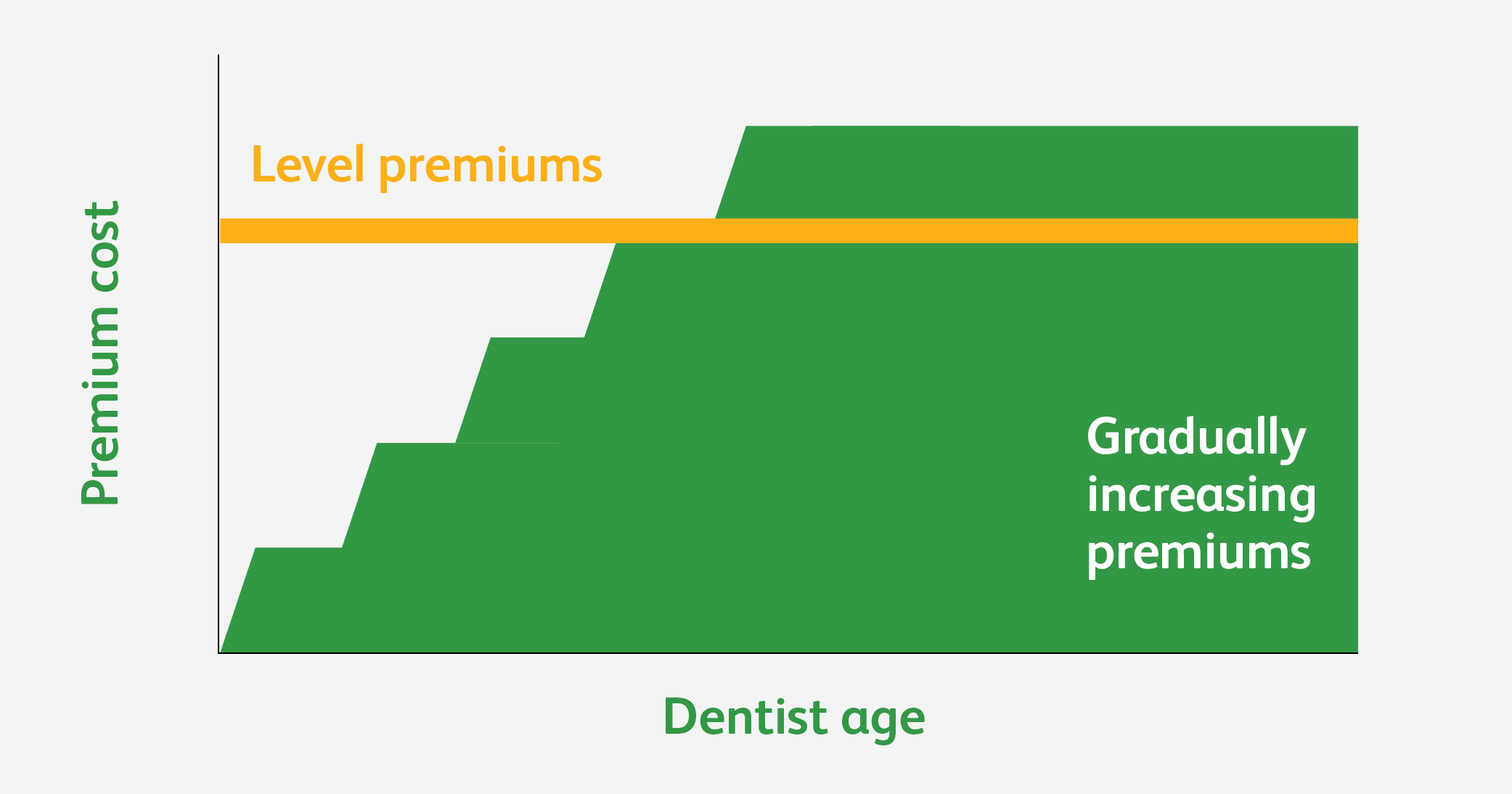

Individual disability insurance policies purchased on the open market typically charge level premiums,

meaning the premium stays the same throughout the life of the policy. Unlike these policies, Protective

offers the ADA Disability Income Protection Insurance with stepped premiums that rise in 5-year bands as you age.*

There are two considerations for dentists when making this choice: Pay more up front to ensure the

same payment over the life of a policy or pay less today for premium payments that gradually increase

over time as you age.

Removing variability in an insurance cost to create a fixed expense may feel reassuring to some

dentists as they plan for the near and distant future. However, more careful consideration can show

that stepped premiums offer the financial flexibility that may make them a better option.

The true cost of level premiums

To keep premiums level over the lifetime of an insurance policy, the insurers offering this option have

to overcharge during earlier years.

When setting premiums for disability income insurance policies, insurers all start with expected benefit

costs that vary by—and typically increase with—age. Those insurers choosing to charge level

premiums then determine the risk of insuring policyholders throughout their policy coverage

period and calculate a level premium high enough to cover the greater risks/higher costs that

arise with advancing age.

This means younger dentists pay more than they need to, based on their risks, in the early years

of their insurance policies. But it also means the dentist would need to hold the insurance policy until the maximum

coverage age to get the full value of selecting the level premium approach.

Stepped premium insurance policies charge a rate based on 5-year age bands—under 30, 30–34, 35–39, 40–44, and so on.

These rates reflect each age group’s actual risk, which means your premiums aren’t inflated in the

early years of your policy.

Rates that match where you are in your career

Having lower insurance costs early in your career can be beneficial. Stepped premiums result

in lower payments in your younger years, when you may be paying off student loans and building

your practice.

By the time higher premiums emerge in later years, you will likely have a higher salary and a

more stable financial situation, which makes you more able to afford increasing premium payments.

An opportunity for significant annual discounts

While individual insurance policy level premiums might appeal to people who want to ensure

that their annual costs never rise, you should also note that your rates will never decrease.

Any savings from the insurer’s actual costs being lower than assumed in the premium are kept

by the insurer—not policyholders. Essentially, that level premium guarantee comes at a potential

cost, and you must consider whether it is worth it.

In contrast, dentists with ADA members group insurance issued by Protective may be

eligible for premium credit reduction.

Protective reviews the group’s claims at least annually to evaluate whether total payouts

for the group were more or less than projected. If the cost of claims was lower than projected,

those savings are passed back to the members via a reduction on their premiums. While not guaranteed,

this reduction has increased by 16% over the last 21 years—from 10% to 26%.i

Long-term savings

The value of stepped premiums is most apparent over time. Through lower group rates and the

opportunity for discounts, you may see significant savings with stepped premiums versus a

level premium policy.

Those savings translate to extra cash flow that you can use to support other financial needs,

such as large student loan payments, while ensuring you and your family are protected should

something happen to you at any point in your career.

Making a decision for a lifetime of financial security

Protecting your earning power with disability insurance is an essential step in protecting your

future. But taking the time to carefully weigh the costs and benefits of different policies

can help you find the best fit for your financial needs.

For a straightforward conversation about different disability insurance premium models, and

a free quote comparison, contact an Insurance Plan Specialist.

*An insured must maintain continuous ADA membership to remain eligible for insurance.

Premiums increase every five years based on age and can also increase or decrease based off underlying gross rate at any point.

iBased on internal premium credit calculations for ADA Disability Income Protection

Insurance from 2004 to 2025. The Premium Credit discount is not guaranteed but reevaluated periodically.